As is often the case with any kind of specialist industry there are often keywords and phrases that are used which you may not always understand. As part of our mission to create transparency we felt that it was important to ensure that our clients and understood exactly what we were saying. So we have put together a list of keywords that you will often see when looking at this subject and tried to explain them as clearly as we could.

Keywords-

Data-

This is the raw set of numbers/ figures and words that a business has collected for market research etc. It remains data until it is given a context. Data is used as parts of a jigsaw to build a bigger picture of an environment or person.

Information-

This is where data has been given a context and it now means something to the business or whoever is looking at it.

Cyber-

This simply relates to the use of anything digital, cyber can be anything from the use of a piece of software to the data/ information held on a hard drive.

Cyber Attack-

This is the term used for when hackers try to get into your systems and steal/ withhold access to your information or other systems to disrupt the businesses operations.

Ddos attack-

This is where a hacker floods your website with traffic to shut it down. Often small websites cannot cope with the traffic volumes and as a result the website crashes.

Trojan horse attack-

This is where a hacker hides a malicious piece of software as something else to get it installed onto a computer and from there they are able to hack into your system.

Ransomware-

This is a piece of software that blocks access to files and other systems until a payment is received and then they may grant access to your files.

General Data Protection Regulations (GDPR)-

These are the new regulations that are coming into force in 2018 to standardise the legislation across border all around the EU. It will be replacing the current data protection act.

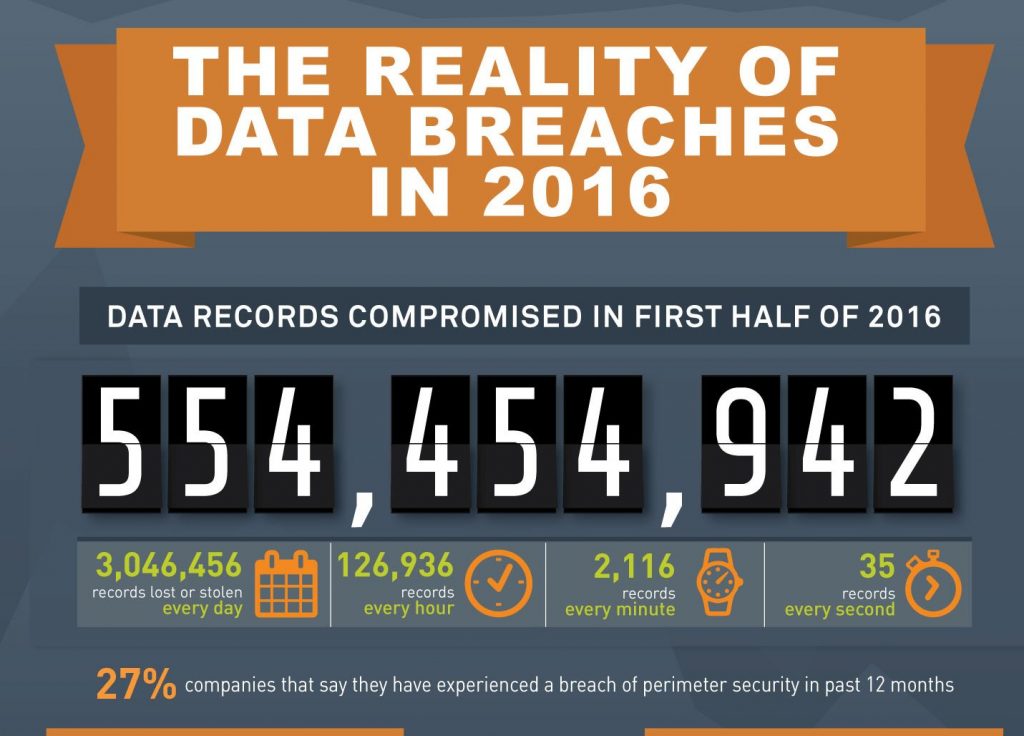

Data breach-

This is where a business suffers from the loss or theft of data that they hold. They are liable for this as data controllers and as a result must notify the relevant authorities.

Now you understand what were going on about, have a read about Cyber insurance you might need it.